|

How Does an FHA Loan Work? . History of. the FHA Loan . Types of FHA Loans . What Are FHA Loan Requirements? . What Are the Federal Housing Administration Loan Limits? . Federal Housing Administration (FHA) Loan Relief . Advantages and Disadvantages of FHA Loans . How Do I Apply for an FHA Loan?. What Is the Max Amount You Can Get From an FHA Loan?. How Much Does FHA Mortgage Insurance Cost?. How Do I Get Rid of My FHA Mortgage Insurance?. What Are the Downsides of FHA Loans?. The Bank's Role in an FHA Loan . Home Equity. Conversion Mortgage (HECM) . FHA 203(k) Improvement Loan . FHA Energy Efficient Mortgage . Section 245(a) Loan . Credit Scores and Down Payments . History of Honoring Debts . Proof of Steady Employment . FHA Mortgage Insurance Premiums (MIPs) . Homes That Qualify for an FHA Loan . Pros and Cons of FHA Loans. Is an FHA Mortgage a Bargain?. Show

Top 1: How Does an FHA Loan Work? - InvestopediaAuthor: investopedia.com - 89 Rating

Description: How Does an FHA Loan Work? . History of. the FHA Loan . Types of FHA Loans . What Are FHA Loan Requirements? . What Are the Federal Housing Administration Loan Limits? . Federal Housing Administration (FHA) Loan Relief . Advantages and Disadvantages of FHA Loans . How Do I Apply for an FHA Loan?. What Is the Max Amount You Can Get From an FHA Loan?. How Much Does FHA Mortgage Insurance Cost?. How Do I Get Rid of My FHA Mortgage Insurance?. What Are the Downsides of FHA Loans?. The Bank's Role in an FHA Loan . Home Equity. Conversion Mortgage (HECM) . FHA 203(k) Improvement Loan . FHA Energy Efficient Mortgage . Section 245(a) Loan . Credit Scores and Down Payments . History of Honoring Debts . Proof of Steady Employment . FHA Mortgage Insurance Premiums (MIPs) . Homes That Qualify for an FHA Loan . Pros and Cons of FHA Loans. Is an FHA Mortgage a Bargain?.

Matching search results: A Federal Housing Administration (FHA) loan is a mortgage that is insured by the FHA and issued by a bank or other approved lender.Grant · Buying a house with bad credit... · Mortgage InsuranceA Federal Housing Administration (FHA) loan is a mortgage that is insured by the FHA and issued by a bank or other approved lender.Grant · Buying a house with bad credit... · Mortgage Insurance ...

Top 2: FHA Loans vs. Conventional Loans: What's the Difference?Author: investopedia.com - 159 Rating

Description: FHA Loans vs. Conventional Loans: An Overview . About. Conventional Loans . Special Considerations . Pros and Cons of FHA Loans . Pros and Cons of Conventional Loans . Other Government-Backed Loans . What is an FHA loan? . What is a conventional loan? What credit scores are required for conventional loans vs. FHA loans? . Mortgage insurance . Click Play to Learn the Differences Between FHA and Conventional Loans.

Matching search results: A Federal Housing Administration (FHA) loan is a mortgage that is insured by the FHA and issued by a bank or other approved lender. ... The loan-to-value (LTV) ...Loans backed by the government: Loans not backed by the governmentMortgage insurance mandatory: Mortgage insurance required if down payment is less than 20%Can only be used to finance a primary residence: Can finance a primary residence, vacation home, rental property, etcLower credit score to qualify: Stricter lending requirementsA Federal Housing Administration (FHA) loan is a mortgage that is insured by the FHA and issued by a bank or other approved lender. ... The loan-to-value (LTV) ...Loans backed by the government: Loans not backed by the governmentMortgage insurance mandatory: Mortgage insurance required if down payment is less than 20%Can only be used to finance a primary residence: Can finance a primary residence, vacation home, rental property, etcLower credit score to qualify: Stricter lending requirements ...

Top 3: Loans | HUD.gov / U.S. Department of Housing and Urban ...Author: hud.gov - 90 Rating

Description: FHA loans have been helping people become homeowners since 1934. How do we do it? The Federal Housing Administration (FHA) - which is part of HUD - insures the loan, so your lender can offer you a better deal.Low down paymentsLow closing costsEasy credit qualifyingWhat does. FHA have for you?Buying y

Matching search results: FHA loans have been helping people become homeowners since 1934. How do we do it? The Federal Housing Administration (FHA) - which is part of HUD - insures ...FHA loans have been helping people become homeowners since 1934. How do we do it? The Federal Housing Administration (FHA) - which is part of HUD - insures ... ...

Top 4: FHA Loans: Requirements, Limits And Rates | Rocket MortgageAuthor: rocketmortgage.com - 105 Rating

Description: FHA Loan Down Payments. FHA Mortgage Insurance. FHA Loans And Credit Score. FHA Income Requirements There are certain requirements borrowers must meet to qualify for an FHA loan, including:The home you consider must be appraised by an FHA-approved appraiser.You can only get a new FHA loan if the h

Matching search results: 18 July 2022 · An FHA loan is a type of government-backed mortgage loan that can allow you to buy a home with looser financial requirements.Mortgage Insurance: PMI if down payment is less than 20%; no PMI if down payment is at least 20%Loan Limits: $647,200 in most areas; up to $970,800 in high-cost areas for a single unitLoan Terms: Loan terms range 8 – 30 yearsWho Backs The Loan?: Fannie Mae or Freddie Mac might buy the loan18 July 2022 · An FHA loan is a type of government-backed mortgage loan that can allow you to buy a home with looser financial requirements.Mortgage Insurance: PMI if down payment is less than 20%; no PMI if down payment is at least 20%Loan Limits: $647,200 in most areas; up to $970,800 in high-cost areas for a single unitLoan Terms: Loan terms range 8 – 30 yearsWho Backs The Loan?: Fannie Mae or Freddie Mac might buy the loan ...

Top 5: FHA loan: What you need to know - NerdWalletAuthor: nerdwallet.com - 97 Rating

Description: What are the differences between an FHA loan and a conventional loan?. What are the types of FHA loans?. How to qualify for an FHA loan. How to apply for an FHA loan. What are the pros and cons of FHA loans?. What is it like to get an FHA loan right now?. Find an FHA-approved lender. Debt-to-income ratio

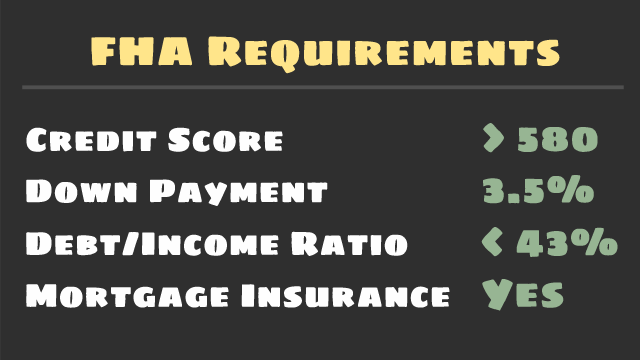

Matching search results: An FHA loan is a mortgage insured by the Federal Housing Administration. With a minimum 3.5% down payment for borrowers with a credit score of 580 or higher, ...An FHA loan is a mortgage insured by the Federal Housing Administration. With a minimum 3.5% down payment for borrowers with a credit score of 580 or higher, ... ...

Top 6: What Is An FHA Loan? – Forbes AdvisorAuthor: forbes.com - 100 Rating

Description: How Does an FHA Loan Work?. FHA Mortgage Insurance. FHA Loan Requirements. Application. and Underwriting. FHA Loans Vs. Conventional Mortgages. Best Mortgage Refinance Lenders of 2022. Frequently Asked Questions (FAQs) . Who Should Consider FHA Loans. Can you refinance an FHA loan?. How to get rid of PMI on an FHA loan. How many FHA loans can you have?. How often are FHA loans denied in underwriting?. Can you get an FHA loan for a mobile home?. Can you build a house with an FHA loan?.

Matching search results: 18 Aug 2022 · There are more than a dozen home loan programs available through the FHA. Many of these programs are ideal for different borrowers in a variety ...18 Aug 2022 · There are more than a dozen home loan programs available through the FHA. Many of these programs are ideal for different borrowers in a variety ... ...

Top 7: FHA Loan Requirements in 2022Author: fha.com - 70 Rating

Description: Important FHA Guidelines for Borrowers. FHA Credit Requirements for 2022. What's a FICO® Score?. SEE YOUR CREDIT SCORES From All 3 Bureaus FHA Loan Credit Issues. Benefits of an FHA Loan. FHA vs. Conventional Loans. Down Payment Assistance in 2022. MIP (Mortgage Insurance Premium). MIP Rates for FHA Loans Over 15 Years. Debt Ratio for FHA Loans. First-Time Homebuyers.

Matching search results: An FHA Loan is a mortgage that's insured by the Federal Housing Administration. They allow borrowers to finance homes with down payments as low as 3.5% and ...An FHA Loan is a mortgage that's insured by the Federal Housing Administration. They allow borrowers to finance homes with down payments as low as 3.5% and ... ...

Top 8: What Is an FHA Loan?Author: fha.com - 55 Rating

Description: FHA Refi and Purchase Loans . SEE YOUR CREDIT SCORES From All 3 Bureaus . Are You Watching Your Credit Score? . FHA loans are insured by the government in order to help increase the availability of affordable housing in the U.S. These loans are backed by the FHA, which protects lenders from sig

Matching search results: An FHA loan is insured by the Federal Housing Administration and protects lenders from financial risk. Lenders have to meet certain criteria for their loans ...An FHA loan is insured by the Federal Housing Administration and protects lenders from financial risk. Lenders have to meet certain criteria for their loans ... ...

Top 9: FHA loans - Consumer Financial Protection BureauAuthor: consumerfinance.gov - 117 Rating

Description: FHA loans are loans from private lenders that are regulated and insured by the Federal Housing Administration (FHA) , a government agency. The FHA doesn’t lend the money directly–private lenders do. FHA loans:Allow for down payments as low as 3.5 percent.Allow lower credit scores than most. conv

Matching search results: FHA loans are loans from private lenders that are regulated and insured by the Federal Housing Administration (FHA) , a government agency. The FHA doesn't ...FHA loans are loans from private lenders that are regulated and insured by the Federal Housing Administration (FHA) , a government agency. The FHA doesn't ... ...

|

Related Posts

Advertising

LATEST NEWS

Advertising

Populer

Advertising

About

Copyright © 2024 SignalDuo Inc.